Don’t you think having the upper hand of technology manages your business payroll system well? Absolutely! That’s the reason why numerous small and medium-sized businesses have elected QuickBooks online as their business accounting software. There’s a feature of Payroll that users can set up and save tons of effort and money. If you’re also deciding to opt for this commendable software and want to learn how to set up Payroll in QuickBooks online, here’s the expert’s guide for you.

Setting up payroll in QuickBooks Online involves several steps to ensure accurate and efficient payroll processing.

“Hey! Hold on. Are you looking for QuickBooks professional technicians to help you set up Payroll in QuickBooks? We got you. Just consider contacting our team at 1-833-210-4702”.

QuickBooks Online Payroll Features

We all are well familiar with QuickBooks and its habit of supporting businesses in accounting, bookkeeping, payroll management, and inventory tracking. The “Payroll” feature in QuickBooks is intentionally designed to help business payroll managers streamline the payroll processing of their company employees. With the help of the QuickBooks web-based payroll feature, accountants can easily and accurately calculate employee payments and business taxes. This service miraculously helps managers calculate employee earnings and cropping of federal and state payroll business taxes.

Basically, there are two types of QuickBooks online Payroll, including Advanced Payroll and Standard Payroll. Based on your business niche and needs, you can choose the type of QuickBooks payroll service and its respective plan.

With so many fortunes and perks of the QuickBooks online payroll service, users can easily stay updated on the rapidly growing business trends. Thus, that’s a good reason businesses must set up Payroll in QuickBooks online. So, without any further delays, let’s continue learning the quick setup process.

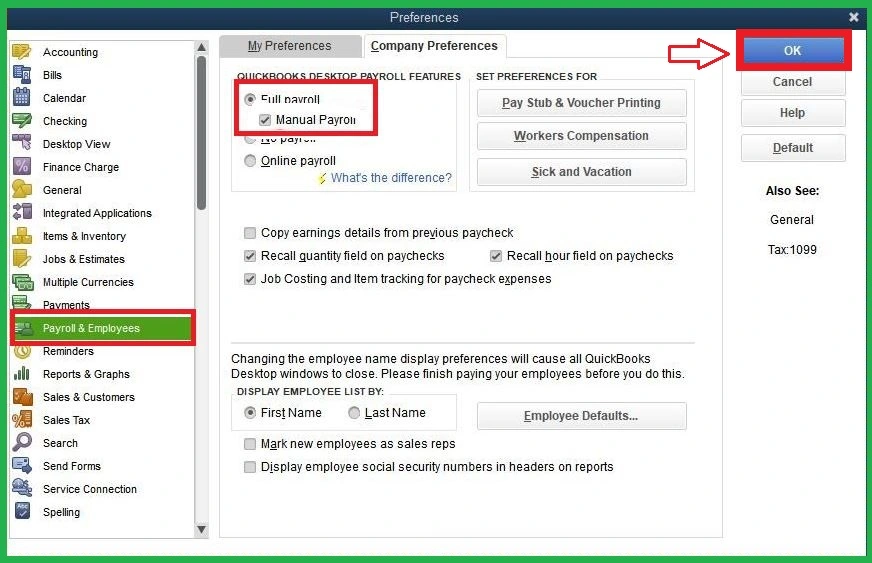

How to Set up Payroll Manually in QuickBooks Online?

The information and stepwise method given below will help you set up Payroll manually in QuickBooks online. We have mentioned the Payroll setup procedure for the Core, Elite, and Premium versions. Once you’ve successfully set up the QuickBooks online payroll, you can pay your employees promptly and accurately and manage business taxes. So, get ready to implement the following steps:

Step 1 – Start by Adding Company and Employee Information

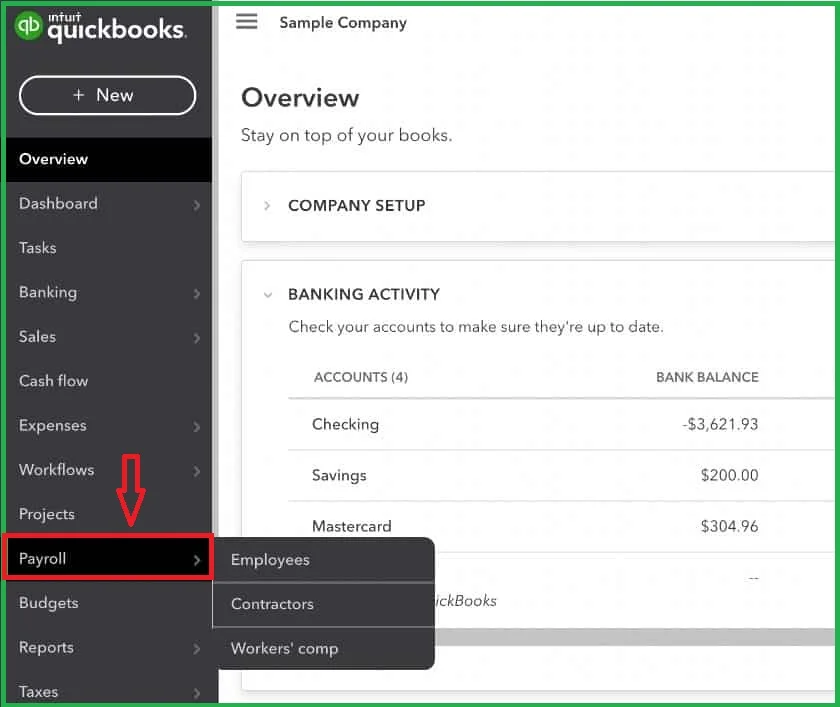

- First of all, open your QuickBooks online application and move to the Employee tab. From here, consider signing in to the account by using your Primary Admin account.

- In the next step, move to the Settings button and hit the Account and Settings option.

- Here, you need to choose the Billing and Subscription alternative, followed by entering the name of your payroll plan.

Step 2 – Enter your Business Data in QuickBooks Online Payroll (Core and Premium)

- Firstly, you must collect all the information related to your business, including the date of your upcoming paychecks and the location of your company employees.

- Also, you must gather your payroll contact’s name, email address, and phone number, along with the main person who pays your company employees.

- Have you gathered all the details? If yes, move to your QuickBooks online application and the payroll alternative.

- In the next step, choose the Overview tab and hit the Get Started option. After this, you will see instructions on your screen to enter the required information.

For Online Payroll Elite Users:

- To enter the required business information in your QuickBooks payroll Elite application, you must collect the information below:

- The exact date of your upcoming Paycheck and the workplace location where most employees work.

- Authentic address of your employees’ location.

- The required and relevant details of the person in charge who manages employee payments.

- Once you’ve collected these details, open your QuickBooks Online Elite application.

- Move to the Payroll tab and choose the Overview option.

Step 3 – Finish All your QuickBooks Online Payroll Setup Tasks

- When you set up Payroll manually in QuickBooks online, you may have to wait for a while. The process takes time. After this, complete the task of paying your employees.

- The next task to do is to navigate to the Payroll feature tab and hit the Overview option.

- Eventually, you must click the Start option on the task you wish to work on.

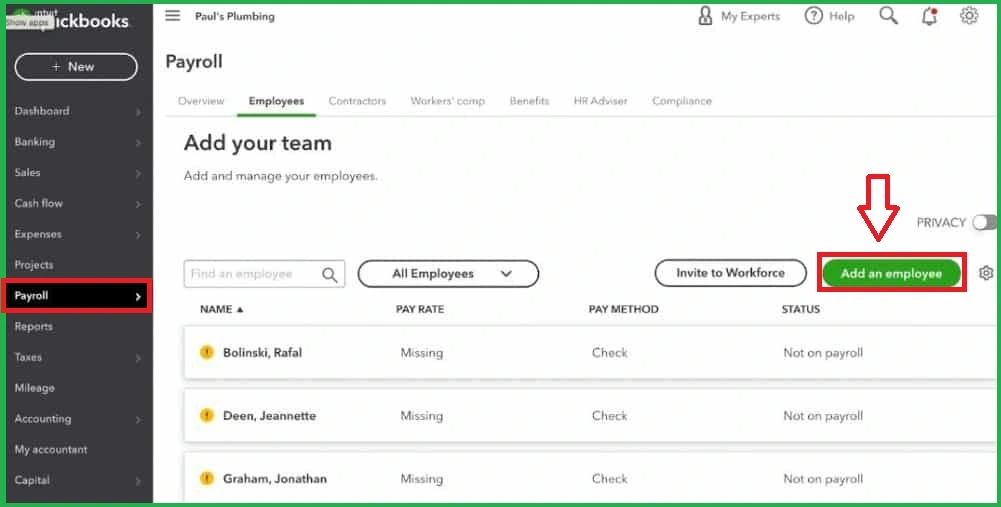

Step 4 – Enter the Information Related to your Entire Team

You must enter the required details of your company team, including the following:

- All the completed W-4 Forms.

- Your employee’s hiring date and DOB (Date of Birth).

- Mention the exact Pay rate.

- If applicable, enter pay card info or bank account details for direct deposit.

- Also, if applicable, provide accurate PTO, holiday, and sick leave rates.

Step 5 – Set up Payroll Tax in QuickBooks Online

- In this step, you just enter the necessary and correct tax information of your business to set up payroll tax in QuickBooks online seamlessly.

- The federal tax information that you must enter here includes:

- Federal Employers in Identification Number (FEIN)

- Frequency of how frequently you pay your business taxes to the IRS and the state, which is your state and federal deposit frequencies.

- Account numbers of state withholding or Unemployment.

- Required rate of state taxes with paid family leaves, surcharges, Unemployment, and state disability.

Step 6 – Add your Payroll History if Already Paid to Employees

If you’ve already paid your company employees this year, enter the information related to your payroll history, including payroll reports or pay stubs.

Payroll reports with all the details of the company’s total wages and taxes for specific and each payment date.

By this, you will successfully set up Payroll manually in QuickBooks online. Now, let’s move ahead and learn how Payroll setup helps business managers.

Why Set up Payroll in QuickBooks Online? What’s the Benefit?

After setting up Payroll into the QuickBooks application, nothing can stop business payroll managers from availing of the notable perks. So, have a look:

1. Maintain Accuracy in Employee’s Pay Records

With the convenience of QuickBooks online payroll, business managers can easily arrange and maintain a seamless management of the company’s employee information and their payment records. In addition, the tasks related to tax authorities and other administrative duties won’t demand huge hours from you and will save you enough time plus effort.

2. Easy Employee Payroll Job Assign

Another benefit you will get once you set up Payroll in QuickBooks Online is assigning employees’ payrolls to their particular tasks. Even you will get the job cost reports generated as easily as a breeze. Additionally, with the QuickBooks online payroll, your employees will get direct funds to their respective bank accounts on time and with no errors.

3. Accurate Payroll Tax Calculations

Unquestionably, no business can bear a single mistake related to their tax preparation and calculation. But, once you establish payroll settings in QuickBooks online and set up the same for your business, you don’t have to worry anymore. In addition, the QuickBooks payroll setup manages this accountable work of preparing and calculating taxes with no chances of miscalculations, inaccurate data, wrong tax preparation, or crossing deadlines.

4. Seamless Employee Management

It’s quite tough to manage employees, their accurate payment records, and all the related information regarding manual operations. Agree? However, when you execute payroll item setup in QuickBooks online and manage employees, a lot of operations get easier. Also, the automation of the web-based QuickBooks payroll handles the entire employee management, considering accuracy, zero errors, and real-time consistency.

5. Tones of Time & Efforts You Save

Indeed! When there is automation, you will always save enough time and effort. Similarly, the automatic payroll settings in QuickBooks online reduce manual efforts and simplify daily payroll chores. Conventionally, when users have to put in their valuable hours and much effort, now, they just have to do some clicks, and all get their payroll tasks done.

Features to Use Once You Set Up Payroll in QuickBooks Online

After setting up the Payroll in your QuickBooks online application, you can access and use the following payroll features:

Unlimited Payroll Runs

Yes, you can enjoy unlimited payroll processes and runs in QuickBooks Online (Core, Elite, and Premium versions). And the good part is, you don’t even have to pay anything extra to get these additional payroll runs.

Automated Payroll Processes

Another feature that you will get with the payroll settings in QuickBooks online is the automated payroll process. This feature helps users run and review employee payroll without any additional entries. The automation also helps you add bonuses and compensation to Payroll.

Simplified Tax Filing and Calculation

As we’ve already discussed, tax filing and calculations must be done carefully since a single mistake can cost your business a lot. However, the automatic mechanism of QuickBooks web-based payroll service simplifies your tax preparation, calculation, and filing.

Employees Direct Deposit

Whether you’re a QuickBooks Elite, Core, or Premium user, you will get free and unlimited direct deposits for your company employees. These direct deposits help you easily pay your employees on time and maintain their accurate payment records.

Relevant & Real-time Information

To continue running your business with immense productivity, you must consider that your employees are getting all the required and relevant information. That’s how, payroll feature helps gather year-to-date earnings, current tax information, pay stubs, time off, W-2 forms, etc.

What Steps to Follow to Run Payroll in QuickBooks Online?

So, have you successfully done with the setup and payroll settings in QuickBooks online? If yes, perform the steps below and start running Payroll in QuickBooks online to access the features we’ve discussed.

In QuickBooks Desktop

- First, to begin this procedure, you must open your QuickBooks online application program.

- Now, move straight to the ‘Employees‘ option, available on the bar’s left side.

- Click this Employees tab and further choose to click the ‘Run Payroll‘ option in the upper right side corner of your window screen.

- Here, your next step is to click the locations tab to continue processing your company payroll. If you notice only one location is available, then it will be chosen by default, and the next tab will eventually open.

- In this step, click the ‘Next‘ button and enter Attendance Details as required. After this, you must click on the +sign button and manually enter employee-wise Loss of Pay details.

- Done up to this, now, hit the arrow icon to upload the attendance in bulk and continue selecting the ‘Next‘ button. Once you do it, then and there, provide the required Pay adjustment details.

- Now, double-tap the employee grid to edit or update your employee payment details, such as bonuses, shift allowances, and incentives.

- After this, you must tap the +sign and continue filling in the employee or component-wise pay information.

- Here, you can take help from an Excel sheet and continue to hit the arrow icon to upload Pay Adjustments details.

- To select employees to run Payroll, click Next and then again to confirm the payroll results. Continue double-clicking the employee option from the employee grid to view the necessary pay details.

- Please ensure that all your payroll additions are correct. Once you’ve verified the correct payroll additions, click the ‘Next‘ option and successfully complete your payroll process.

- Select the Lock Payroll option and Post JV entry once you’ve selected the Download Salary Register. Finally, press the ‘Done‘ option and decide on your company employees’ monthly Payroll.

Additional Tips:

- QuickBooks Online offers customer support and resources, so don’t hesitate to reach out if you encounter any issues.

- Keep your payroll information up-to-date, especially when there are changes in employee details, tax laws, or other relevant factors.

Ask Our Professionals to Know More..!

QuickBooks Online is popular all over the globe, and we suggest you immediately switch to the application if you haven’t still. From managing employee payroll to preparing tax filings and much more, the application will help you thoroughly. So, set up Payroll in QuickBooks online by following the instructions above. But, we understand that many users may face technical issues with the payroll settings. If the case is the same for you, reach out to us via Live Chat Support. Eventually, our professional technicians will immediately assist and help you.

Frequently Asked Questions

- Log in to your QuickBooks Online account.

- From the left navigation bar, select “Employees.”

- Click on the “Get Started” button in the Payroll section.

- Follow the prompts to enter necessary information, such as your business details, employee information, tax details, and bank account information for payroll transactions.

Gather essential information before setting up payroll, including your business details, employee information (names, addresses, Social Security numbers, etc.), federal and state tax identification numbers, and bank account details for payroll transactions. Additionally, ensure you have accurate information on employee earnings, deductions, and benefits.

- After setting up payroll, go to the “Employees” menu and select “Employees Center.”

- Click on the employee for whom you want to set up direct deposit.

- Select the “Pay” tab and then click on “Direct Deposit.”

- Follow the instructions to enter the employee’s bank information and set up direct deposit.

- QuickBooks Online Payroll handles federal and state tax calculations for you. Make sure you have accurate tax information entered during the setup process.

- Verify that your payroll items (wages, deductions, benefits) are set up correctly with the appropriate taxability.

- Stay informed about tax filing deadlines and make timely payments to the appropriate tax agencies using the Pay Taxes feature in QuickBooks Online.

- To run payroll, go to the “Employees” menu and select “Run Payroll.”

- Choose the pay schedule, review the list of employees, and enter hours worked or salaries.

- Confirm the details, and if everything is accurate, click “Submit Payroll.”

- After running payroll, you may need to print paychecks, provide direct deposit advice to employees, or process other payroll-related tasks.

Below, you can find how to record Payroll in QuickBooks online manually:

- Firstly, create a manual tracking account that will help you track your company payroll expenses and liability.

- Done? Secondly, you must collect your employees’ payroll stubs/ payroll reports from your payroll policy.

- After this, choose the Select button and click the Journal Entry alternative. Now, move to the Journal Date column and enter your paycheck date.

- Finally, to track your paycheck number, provide the necessary details in the Journal no. filed.